関連ワード:

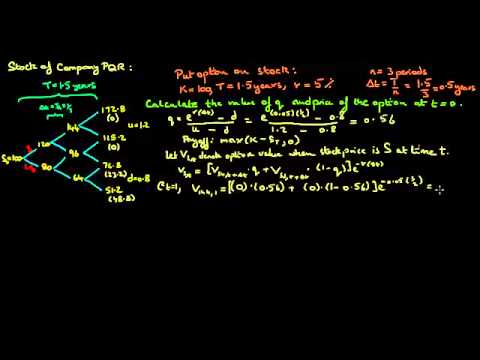

binomial model pricing binomial model pricing options binomial pricing model formula binomial pricing model calculator binomial pricing model python binomial pricing model excel binomial pricing model example binomial pricing model assumptions binomial pricing model pdf binomial pricing model risk neutral probability