関連ワード:

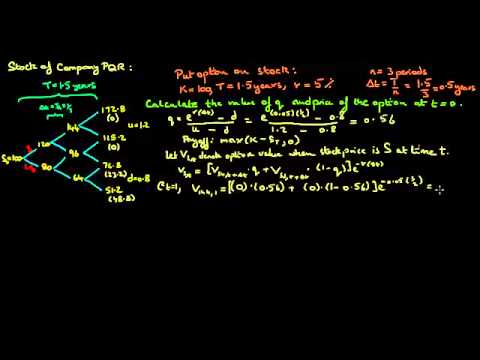

binomial option pricing model example binomial option pricing model example step by step binomial option pricing model formula two period binomial option pricing model examples binomial option pricing example two step binomial option pricing model formula 2 period binomial option pricing model formula what is binomial option pricing model