関連ワード:

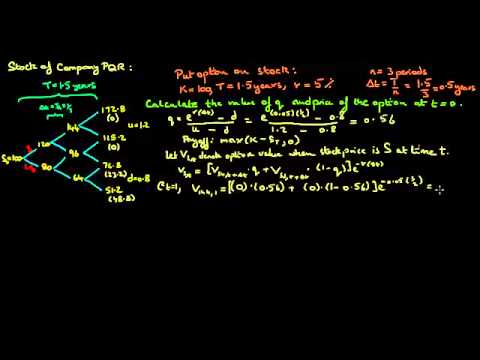

binomial tree risk neutral probability binomial model risk neutral probability binomial model risk neutral probability formula binomial tree option pricing risk neutral probability binomial pricing model risk neutral probability binomial option pricing model risk neutral probability risk neutral probability binomial tree formula binomial probability examples