関連ワード:

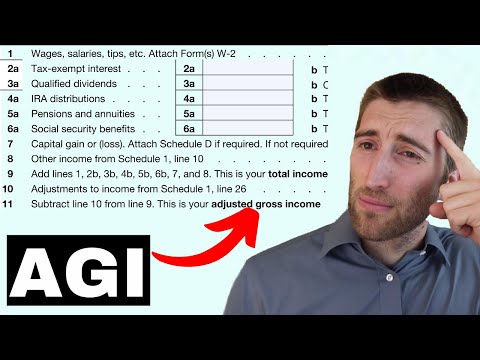

does gross income include deductions does gross pay include deductions does gross salary include deductions does total income include deductions does gross earnings include deductions does adjusted gross income include deductions does gross income include tax deductions does gross income include 401k deductions does gross income include pre tax deductions does gross monthly income include deductions