関連ワード:

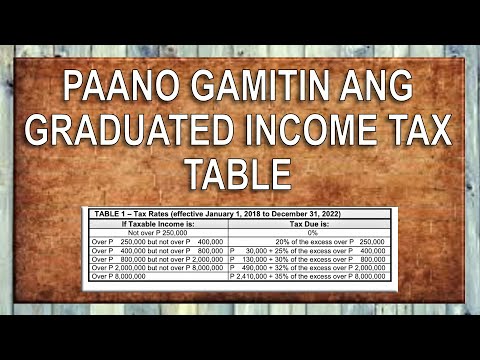

how to calculate annual taxable income philippines how to compute annual income tax philippines how to compute annual compensation income tax philippines how to compute annual itr philippines how do you calculate annual taxable income how do i find my annual taxable income what is my annual taxable income how to calculate annual taxable income where can i find my annual taxable income