関連ワード:

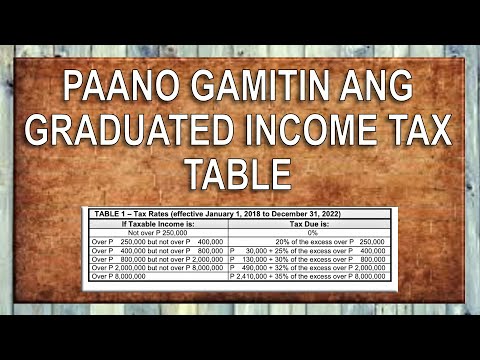

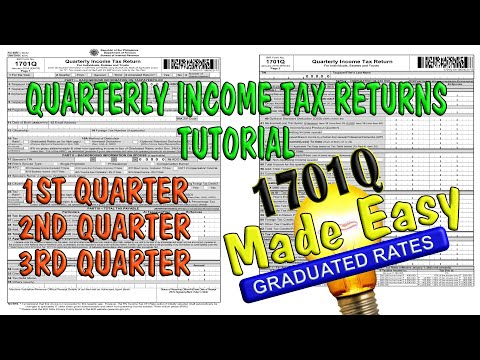

how to compute annual income tax how to compute annual income tax philippines how to compute annual income tax return for business how to compute annual income tax return philippines how to compute annual income tax return 1701a how to compute annual income tax return 2316 how to compute annual income tax for sole proprietorship in the philippines how to compute annual income tax return 1701 how to compute yearly tax how do you calculate annual taxable income