関連ワード:

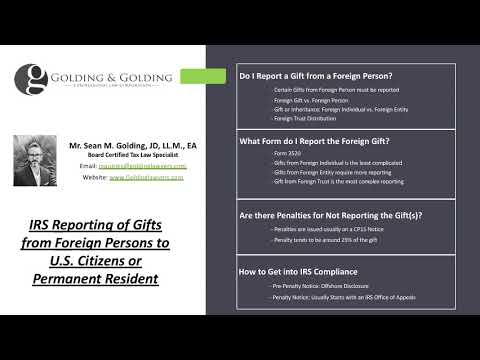

irs reporting for gifts irs rules for gifts to customers irs rules for gifts to employees irs reporting requirements for gifts irs reporting gifts from foreign irs form for reporting gifts irs rules for client gifts irs rules gifts to relatives do you have to report a gift to the irs how much can you gift without reporting to irs