関連ワード:

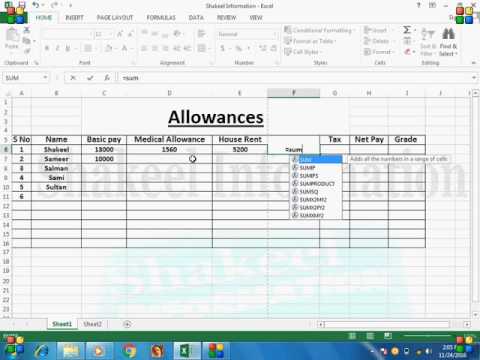

medical allowance percentage in salary medical allowance percentage in salary per month medical reimbursement percentage in salary medical allowance percentage of basic salary how to calculate medical allowance in salary how is medical allowance calculated from basic salary medical allowance percentage