関連ワード:

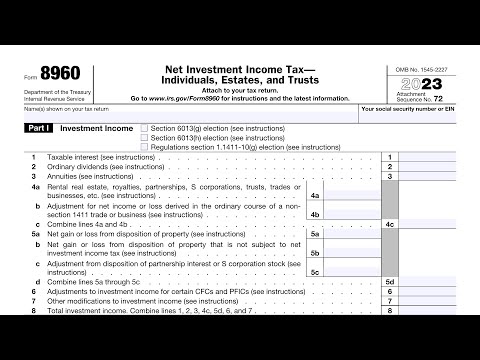

net investment income tax brackets net investment income tax brackets 2024 net investment income tax rate net investment income tax thresholds net investment income tax percentage net investment income tax schedule 2 line 12 net investment income tax rate 2022 net investment income tax schedule 2 net investment income tax rate 2025 net investment income tax schedule