関連ワード:

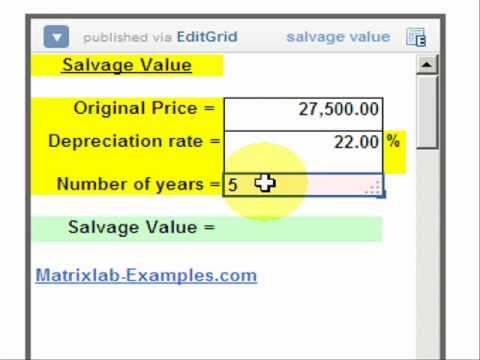

straight line depreciation with no residual value straight line depreciation with no salvage value straight line method with no residual value straight line depreciation formula with no residual value straight line method with no salvage value straight line depreciation without residual value depreciation straight line method no residual value straight line depreciation formula without residual value straight line method of depreciation without residual value calculating straight line depreciation without salvage value