関連ワード:

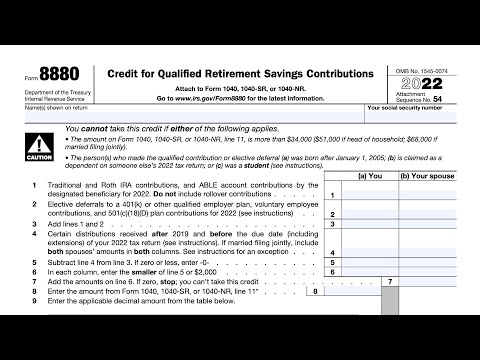

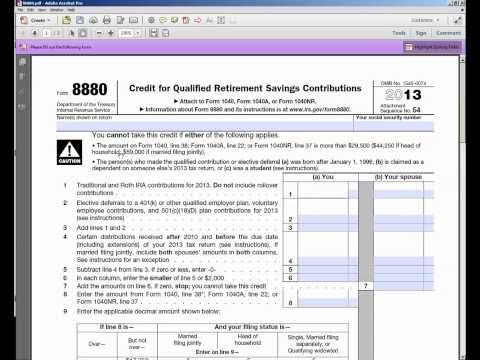

what is retirement savings contribution credit turbotax retirement savings contribution credit turbotax reddit retirement savings contribution credit turbotax error retirement savings contribution credit turbotax deluxe what is retirement savings contribution credit how much is the retirement savings contribution credit