関連ワード:

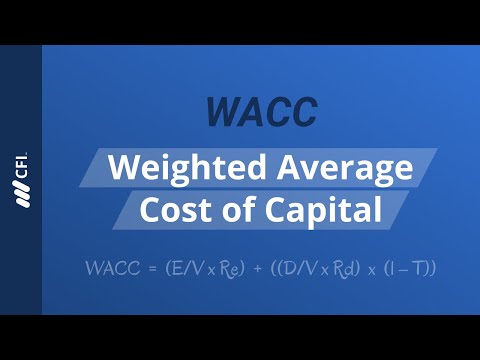

what is the firm's weighted average cost of capital what is the company's weighted average cost of capital given the following information what is the firm's weighted average cost of capital what is weighted average cost of capital (wacc) how do you find the weighted average cost of capital what is the current weighted average cost of capital what is a good weighted average cost of capital