関連ワード:

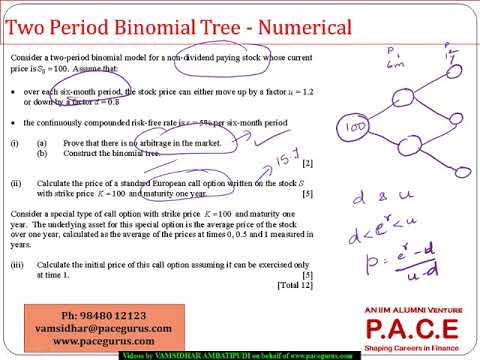

binomial asset pricing model binomial asset pricing model book binomial asset pricing model pdf binomial asset pricing model formula binomial option pricing model binomial option pricing model calculator binomial option pricing model formula binomial option pricing model example binomial option pricing model pdf binomial option pricing model excel